Colocation as a Key Model for Modern IT Infrastructures

The demands on digital infrastructures are growing rapidly – driven by data-intensive applications, cloud services, AI models, and the ongoing digitalization of the economy. Companies are increasingly facing the challenge of designing their IT environments to be flexible, secure, and efficient. The colocation model plays a central role in this: the outsourcing of server and network technology to professionally operated data centers.

Colocation offers companies the opportunity to operate their own hardware in a highly available environment – without the effort and costs of building and operating their own data center. In Germany, this market segment has developed rapidly in recent years: It not only shapes the structure of the data center landscape but is increasingly becoming a driver for innovation, sustainability, and economic value creation.

This article provides an overview of the current status of the colocation market in Germany. It sheds light on central trends, regional focus areas – particularly the Rhine-Main region with Frankfurt as the most important location – as well as regulatory developments and future perspectives.

Status Quo of the Colocation Market in Germany

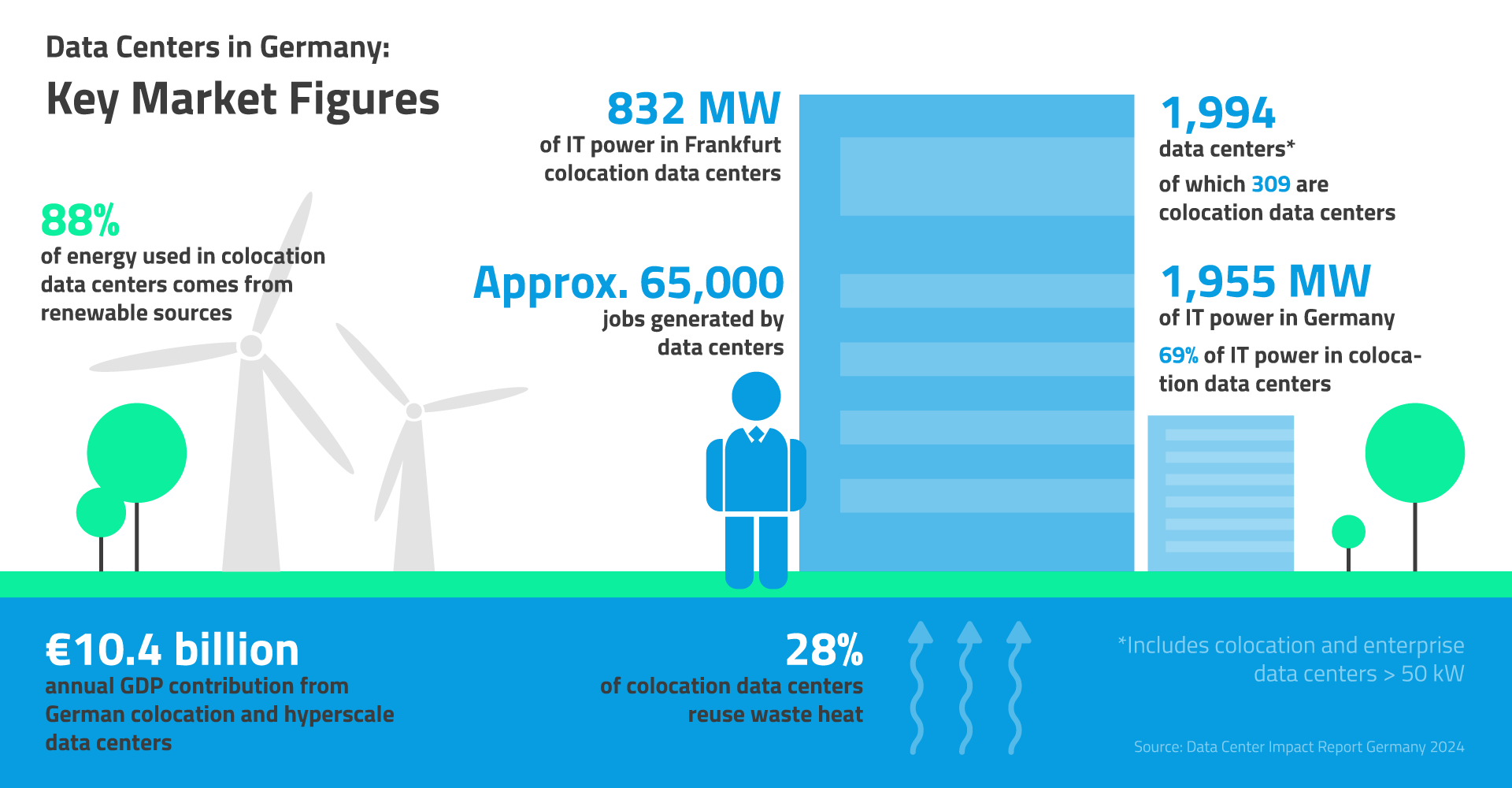

Germany is now one of the most important colocation markets in Europe – and continues to grow. The trend towards outsourcing IT infrastructures to specialized data centers is also reflected in the distribution of capacities: Around 70% of the total data center capacity in Germany is now accounted for by colocation facilities. This corresponds to approximately 1,360 megawatts out of a total of 1,955 MW of available IT capacity – with an upward trend.

Another indication of the increasing importance: Almost half of all data center capacities in Germany are now located in colocation buildings. The classic separation between in-house operations (enterprise data centers) and external infrastructure is becoming increasingly blurred, as large companies and hyperscalers like Amazon, Microsoft, and Google are increasingly relying on colocation spaces.

The strength of the German market becomes particularly clear in international comparison. According to DataCenterMap, Germany currently operates more colocation data centers (425) than the United Kingdom (420) – putting it at the top in European comparison. The market dynamics are also reflected in ambitious expansion plans: Within the next five years, the capacity of the colocation market is expected to more than double, from currently around 1.3 GW to over 3.3 GW.

At the same time, there is a consolidation in the market: The number of smaller colocation data centers (from about 50 kW IT capacity) is decreasing. Many of these operators are discontinuing their services or moving servers to larger, more efficient facilities. This underlines the trend towards economies of scale and professional structures in data center operations.

Regional Focus: Frankfurt and the Rhine-Main Area in the Spotlight

A look at the geographical distribution of colocation capacities shows a clear concentration in a few metropolitan areas. The undisputed leader in Germany is the Frankfurt am Main metropolitan region – it forms the heart of the German data center landscape.

Almost two-thirds of the available IT capacity in colocation data centers are located in the Greater Frankfurt area. The region benefits from its central location in Europe, excellent network connections (e.g., through the DE-CIX internet exchange point), proximity to financial institutions, industry, and international corporations – as well as from a historically grown infrastructure.

Frankfurt is not only one of the most important locations for data centers nationally, but also internationally. The city is part of the so-called FLAP-D market – one of the most important European clusters for digital infrastructures, consisting of Frankfurt, London, Amsterdam, Paris and Dublin.

Besides Frankfurt, other locations such as Berlin-Brandenburg and Munich are also increasingly coming into focus for investors and operators. In Berlin, in particular, the demand for colocation space is growing. In Munich, operators are confident about further market development.

However, the high concentration in urban areas also brings challenges. In Frankfurt and Berlin, there are already signs of overload: The availability of suitable land and sufficient power connection capacities is increasingly becoming a bottleneck for further expansion. This leads to rising costs, longer approval procedures, and growing competition for resources – and could lead to stronger decentralization in the medium term.

Trends Developments in the Colocation Market

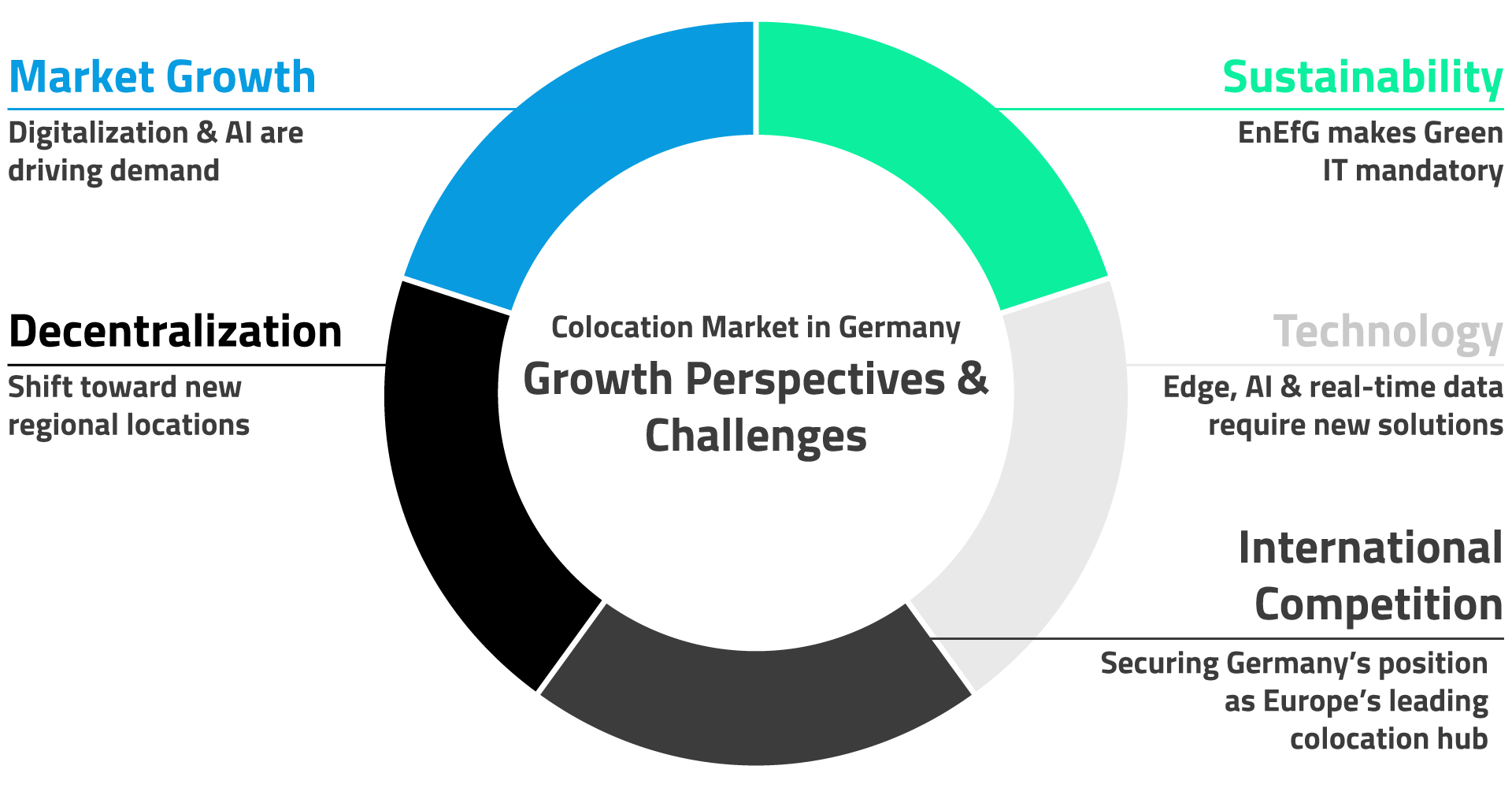

The colocation market in Germany is in a dynamic phase of transformation. In addition to ongoing growth, several structural developments and trends can be observed that will shape the market environment in the coming years.

1. Capacity Expansion and Market Consolidation

The demand for data center space – especially for highly available, sustainable, and scalable colocation offerings – is growing continuously. Forecasts predict that the available colocation capacity in Germany will more than double from currently around 1.3 GW to over 3.3 GW within the next five years. This corresponds to one of the strongest growth paths in European comparison.

At the same time, the consolidation of the market continues: Smaller operators are increasingly disappearing from the market or being acquired. Large providers dominate the scene, leading to more professional structures, more efficient operating models, and stronger standardization.

2. Increasing Importance of Hybrid IT Architectures

While companies used to have to choose between on-premises, colocation, or cloud, hybrid architectures are becoming increasingly prevalent today. Companies combine different operating models to optimally balance flexibility, security, and performance. In this context, colocation often serves as a stable backbone for business-critical applications – supplemented by cloud components for scalable workloads.

3. Demand from Hyperscalers and National Cloud Providers

International hyperscalers such as Amazon Web Services, Microsoft Azure, or Google Cloud heavily rely on colocation space when expanding their presence in Germany – not least to efficiently meet local data protection requirements and operational conditions. At the same time, more and more national providers and system houses are using colocation to flexibly scale their services without having to invest in data center infrastructure themselves.

Sustainability and Regulation: Between Obligation and Competitive Advantage

In the wake of increasing energy demand and political climate goals, the topic of sustainability is becoming increasingly important in the colocation market. At the same time, legal requirements are becoming stricter – particularly through the new Energy Efficiency Act (EnEfG), which presents new challenges for data center operators but also opens up opportunities.

1. High Share of Renewable Energy

Already today, many colocation data centers in Germany are among the most energy-efficient infrastructures in the digital world. About 88% of the electricity consumed already comes from renewable sources. A large proportion of operators obtain green electricity through so-called Power Purchase Agreements (PPA), thereby actively participating in the expansion of renewable energy sources in Germany.

Green certificates and guarantees of origin also play an important role in sustainable electricity procurement and verification for customers and authorities.

2. Energy Efficiency and PUE Targets

Power Usage Effectiveness (PUE) is a key metric for evaluating the energy efficiency of a data center. On average, colocation data centers in Germany currently achieve a PUE value of 1.3. Only a small portion of facilities already fall below the ambitious target value of 1.2.

The new EnEfG tightens the requirements:

- New data centers (> 300 kW IT power) that go into operation from July 2026 must maintain a PUE value of no more than 1.2.

- For existing facilities, from July 2027, a limit of 1.5 initially applies, then 1.3 from 2030.

These requirements increase the pressure on operators to invest in energy-efficient technology, modern cooling systems, and intelligent control solutions.

3. Waste Heat Utilization on the Rise

Another central topic in the context of sustainability is the utilization of waste heat, which is generated in large quantities in data centers. According to the survey, 28% of operators already state that they actively reuse their waste heat – for example, for building heating or feeding into local heating networks. Another 31% are investing in the necessary technology.

For data centers with a capacity of over 1 MW, the EnEfG also requires a mandatory cost-benefit analysis for waste heat utilization – a step that could lead to better integration into municipal infrastructures in the long term.

4. Regulatory Challenges and Opportunities

In addition to the opportunities through energy efficiency and sustainability, increasing regulation also poses risks:

- Reporting obligations, as envisaged by the EnEfG (e.g., annual proof of customer-specific energy consumption), in some cases go beyond EU requirements.

- Some operators fear this could lead to location disadvantages compared to other European countries.

At the same time, new competitive advantages are emerging: Providers who meet regulatory requirements early and communicate transparently gain the trust of customers and investors – and successfully position themselves as future-proof partners.

Economic Significance of the Colocation Industry

The data center industry – and especially the colocation segment – is making an increasingly important contribution to the German economy. The combination of digital infrastructure, sustainable energy supply, and strategic location selection makes colocation a central component of the digital value chain.

According to current surveys, colocation and hyperscale data centers in Germany contribute around 10.4 billion euros annually to the Gross Domestic Product (GDP). This economic contribution is expected to rise sharply in the coming years: By 2029, this value is expected to more than double to around 23 billion euros.

This development shows: Colocation is much more than a technical necessity. The operation of modern data centers creates jobs, promotes innovation in related industries (such as IT security, network technology, or energy management) and forms the basis for digital business models in almost all economic sectors.

For municipalities and regions, the establishment of colocation infrastructure often means a direct economic benefit – for example, through trade tax revenues, collaborations with local energy suppliers, or targeted investments in network expansion and site development.

Last but not least, data centers are a strategic factor for the digital sovereignty of Germany and Europe – especially with regard to data protection, cloud regulation, and innovation capability in international competition.

Outlook: What's Next in the Colocation Market?

The colocation market in Germany is facing a decade of profound changes – with promising growth prospects, but also new challenges. The course for a sustainable, high-performance, and future-oriented digital infrastructure is already being set today.

1. Growth Continues

The forecasts for capacity expansion clearly show: The market will continue to grow. Driven by digitalization, AI, IoT, and cloud services, the demand for professional data center services remains high – both among medium-sized companies and global cloud providers. At the same time, the need for higher reliability, scalability, and energy-efficient operation is increasing.

2. Decentralization as a Possible Counter-Trend

While Frankfurt is likely to remain the dominant location, shortages in power connections, land, and permits could lead to a shift to new regions in the medium term. Rural and peripheral areas that offer good network connectivity and favorable energy costs could benefit – provided regulatory frameworks favor investments.

3. Sustainability as a Differentiating Factor

The coming years will show which providers manage to translate the regulatory requirements of the EnEfG into efficient and transparent sustainability strategies. Green IT will become a decisive factor – not only for regulatory reasons but also in terms of customer requirements and ESG criteria of investors.

4. New Requirements Through Technology and Society

Artificial intelligence, digital twins, autonomous systems, and data-intensive real-time applications are placing new demands on latency, bandwidth, and security. The colocation market will have to respond with innovative operating models, edge integration, and improved connectivity solutions.

5. Germany in International Competition

Germany has established itself as a leading colocation location in Europe. The position within the FLAP-D markets must be maintained – through investments, political foresight, and a clear focus on innovation and sustainability. The coming years will be decisive in determining whether Germany can further expand its role as a preferred location for digital infrastructure.

Conclusion: Colocation in Germany - A Market on the Move

The colocation market in Germany has developed rapidly in recent years and now plays a key role in the digital ecosystem. The combination of growing demand, technological change, pressure for sustainability, and regulatory requirements creates a dynamic market environment that offers both opportunities and challenges.

In particular, the Rhine-Main area with Frankfurt as the leading location exemplifies how regional infrastructures can develop into international hubs – with high economic relevance and enormous innovation potential.

At the same time, the importance of sustainable operating models and legally compliant energy efficiency is growing. Companies that adapt to these requirements early on gain long-term competitive advantages and position themselves as reliable partners in the digital transformation.

Colocation is no longer just a technical operational approach – it is a strategic instrument for shaping a resilient, future-proof, and sustainable IT landscape in Germany.