A Look at the German Data Center Industry

The German data center industry is facing a period of significant growth, driven by technological developments, regulatory requirements, and increasing demand for AI and cloud services. The industry association German Datacenter Association has therefore published the “German Datacenter Outlook 2024/25”, which provides a comprehensive overview of the key trends and challenges for the coming years.

In the following, we summarize the most important findings of the report briefly and clearly.

Growth of the Data Center Market in Germany

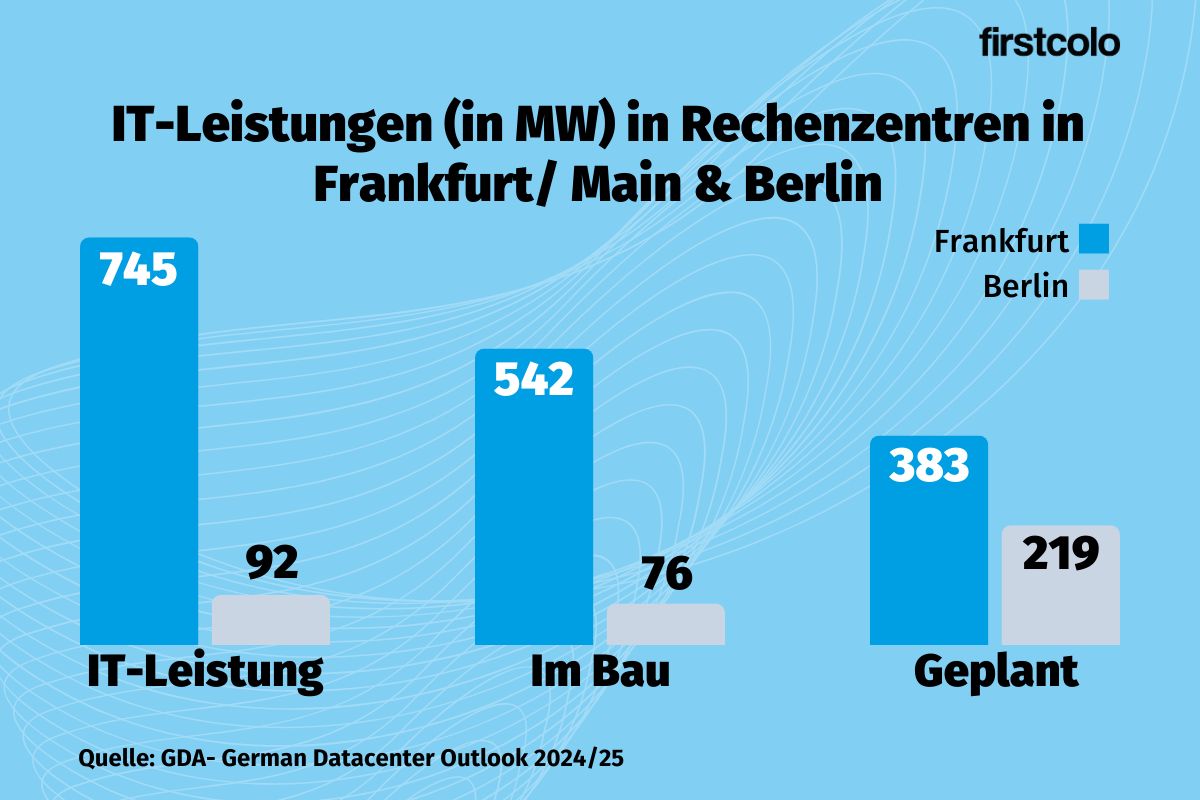

Germany remains one of the most important data center locations in Europe. Frankfurt am Main, in particular, is establishing itself as the second-largest market in Europe after London. The location has an IT load of 745 MW, with 542 MW under construction and another 383 MW in planning. Berlin follows with 92 MW IT load, 76 MW under construction, and 219 MW in planning. The Rhineland region is also gaining importance, fueled by Microsoft’s announcement to build two new data centers in Bergheim and Bedburg.

By 2029, the IT capacity of colocation data centers in Germany is expected to increase from the current 1.3 GW to 3.3 GW. This corresponds to investments of over 24 billion euros.

Challenges: Regulation, Energy, and Site Availability

The growing demand for data center capacities also brings new regulatory requirements. The Energy Efficiency Ordinance (EnEfG) increasingly obliges data centers to use renewable energies and utilize waste heat. Capacity limits are already visible in Frankfurt, favoring the expansion of alternative locations such as Berlin and the Rhineland region.

Another problem is the limited availability of electricity. The estimated annual electricity usage of German data centers is currently 17.9 billion kWh – almost 50 percent more than the annual consumption of the city of Berlin. The increasing demand from AI and cloud services could further increase these figures.

Artificial Intelligence and Its Impact on Data Centers

The rapid development of AI, especially large language models, requires more powerful data centers. AI-powered workloads require four to five times more computing power than conventional search queries. However, new server generations with higher performance generate significantly more waste heat and require new cooling technologies.

One trend is the migration of AI training models from the USA to Europe, driven by data protection requirements and regulatory guidelines. At the same time, European infrastructure must be adapted to these developments, particularly in terms of energy supply and site selection.

Innovations in Cooling Technology

The increasing power density in data centers is leading to a paradigm shift in cooling technology. Air cooling is reaching its limits, which is why direct liquid cooling is considered a key technology for the future. Manufacturers such as Rittal and Stulz are developing new concepts for liquid cooling to meet the increasing requirements of AI and high-performance data centers.

In particular, Single-Phase Direct Liquid Cooling is gaining importance as it enables efficient heat dissipation and allows better integration of waste heat utilization. By 2025, up to 85 percent of newly delivered Nvidia chips are expected to be designed for liquid cooling.

Sustainability and Waste Heat Utilization

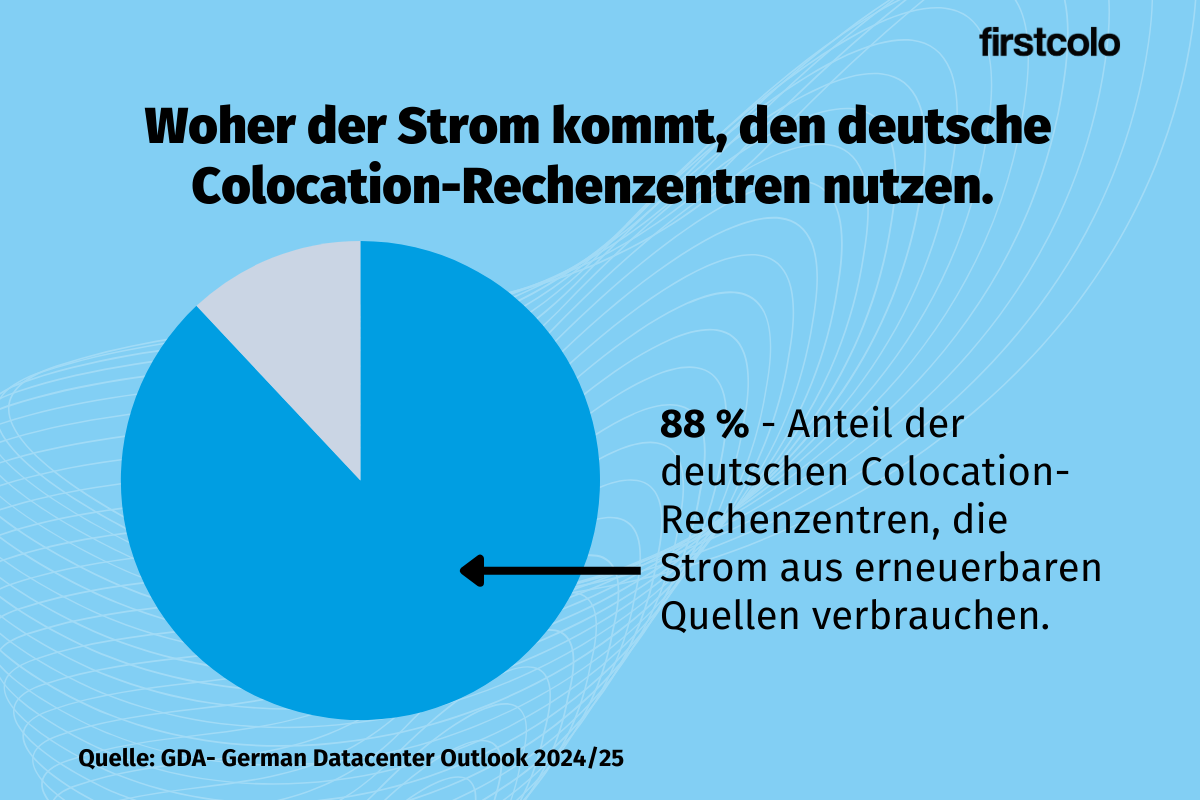

Sustainability remains a central topic in the industry. The report shows that 88 percent of the electricity consumed in German colocation data centers already comes from renewable sources. In addition, 69 percent of operators have concluded Power Purchase Agreements (PPAs) to cover their energy needs with renewable energies in the long term.

Another focus is on the utilization of waste heat. The integration of data centers into urban heating networks is increasingly demanded. As legislation in Germany will soon make this mandatory, operators are investing more in concepts for heat recovery.

Shortage of Skilled Workers as a Central Challenge

The industry is facing an increasing shortage of skilled workers. Currently, there are around 65,000 direct and indirect jobs in the data center sector in Germany. 65 percent of colocation providers outside Frankfurt cite the skills shortage as their biggest challenge. Initiatives such as the “Open Data Center Day” and increased collaborations with universities aim to raise the industry’s visibility and attract new talent.

Conclusion

The “German Datacenter Outlook 2024/25” by the industry association German Datacenter Association shows an industry in transition. While the market is growing rapidly, operators face significant challenges in energy supply, regulation, and skilled labor shortages. At the same time, innovations in cooling, AI optimization, and sustainability are driving the future of the data center landscape in Germany. The coming years will be crucial for creating sustainable and high-performance digital infrastructures.

Download the Report

The “German Datacenter Outlook 2024/25” can be downloaded for free from the German Datacenter Association website.